Moving Floor - Automatic cleaning for farm animals.

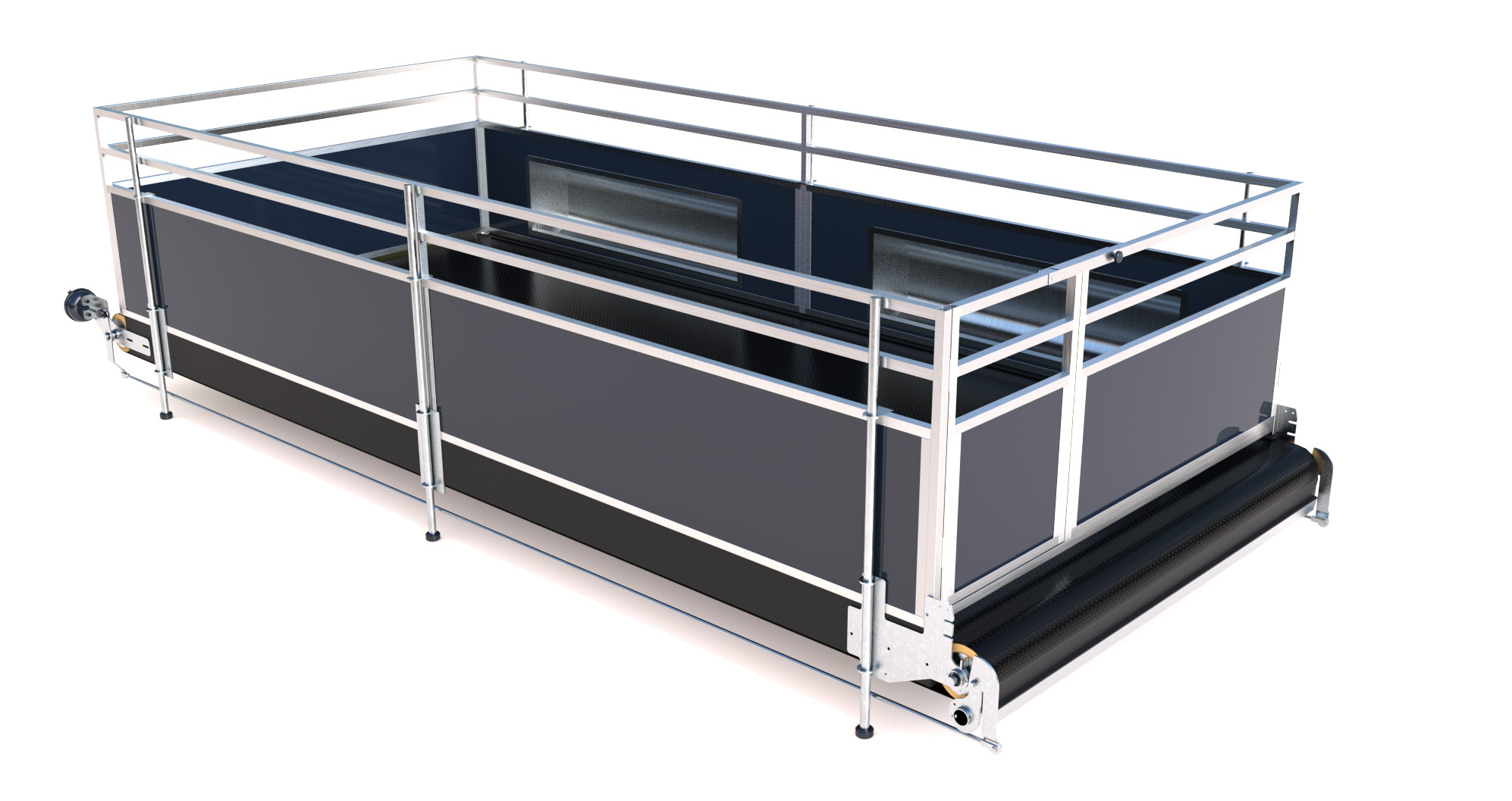

Group box

The Moving Floor Groupbox is, unlike traditional calf pens or hutches, programmed to clean and distribute bedding automatically in your desired interval. Clean and healthy calves grow faster and become better dairy cows. Take care of the most important thing you have in your crew – your recruitment – your future cash cows!

READ MORESingle box

It is now possible to clean a singlebox or calf pen while the calf is still there. Simply pull the handle and the top cover underneath the calf will rotate and get scraped off. A soft mattress under the top cover will provide comfort to the calf. By cleaning out several times per day you increase hygiene and avoid flies. Cleaning singleboxes just became very easy!

READ MORECubicle

The self-cleaning cubicle is cleaned every time the cow leaves the cow stall, using only the weight of the cow. Reliable and extremely profitable. It’s really common sense that a cow should not lie down in a bed with another cow’s manure and leaking milk. Hygiene is crucial for the health and productivity of a cow.

READ MOREPig equipment

Moving Floor Pig equipment is cleaned 10-15 times/day without using any water at all. This continous cleaning helps reducing the ammonia emissions by 85%. Healthy animals grow better and need less antibiotics. With Moving Floor pig equipment you can also build the barns to a lower cost than conventional barns with slatted floors.

READ MORE